The share of cash payments in retail is declining. However, many merchants refuse to accept card payments due to the perceived high fees associated with them. But there are also hidden costs associated with cash payments.

What are the costs of cash handling for the merchant? ?

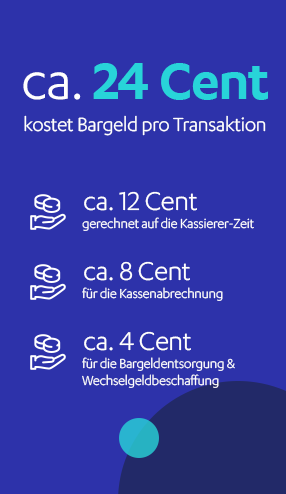

Cash is not free of charge for merchants either, as shown by a study conducted by the German Federal Bank.¹

According to them, the costs of a cash transaction average 24 cents. They are divided as follows: Approximately 12 cents for cashier time, 8 cents for cash reconciliation, and finally about 4 cents for cash disposal and change procurement.

The costs are in the details

Cash payments entail various costs for merchants. The staff responsible for handling cash payments and conducting cash reconciliation must be paid initially. During shift changes, cash in the register is routinely counted, and typically, the money is reconciled and packaged after the close of business. The time and associated costs are greatly increased by multiple counts and the commonly applied "four-eyes principle." Additionally, time is further consumed by human errors during the workday.

The journey to the nearest bank is getting longer as more and more staffed bank branches are closing down, which drives up costs for the merchant. Additionally, there are fees for processing cash at so-called cash centers and for deposits at banks. Furthermore, there are costs associated with the constant provision of sufficient change in the cash register.

Cash payment and card payment

Cashless and contactless purchases are more hygienic than cash, which is one reason why card payments gained popularity during the COVID-19 pandemic. Processing cash payments takes longer as the money needs to be counted, packaged, and transported, whereas with card payments, the money is simply transferred to the account.

The advantage of card payments also extends to security. Carrying large amounts of cash poses the risk of robbery, both within the store and on the way to the bank. Another issue is human errors in handling money. This could lead to unintentional acceptance of counterfeit money or mistakes in giving change. As a result, the retail sector experiences cash deficits amounting to 17 million euros annually.

Conclusion

Each payment method incurs costs for the merchant, whether it's cash or card payment. The decision lies solely with the merchant on whether to offer the option of card payment, which has been proven to increase customer satisfaction. Start conveniently and easily with our complete package for cashless payments and increase your revenue now.

For further questions on this topic or any other inquiries, we are also available to assist you by phone. Feel free to contact us.

¹ https://www.bundesbank.de/de/aufgaben/themen/studie-zahlungen-mit-bargeld-sind-schnell-und-guenstig-776512#:~:text=Insbesondere%20Barzahlungen%20bis%2050%20Euro,von%2033%20beziehungsweise%2034%20Cent

² https://www.bundesbank.de/resource/blob/776464/7bcafc28a7be62b503fb4c39440f92db/mL/kosten-der-bargeldzahlung-im-einzelhandel-data.pdf