- Cross-Industry, Up to 86% of Payments Made Contactlessly in DACH Region Countries by End of 2021

- The Share of Contactless Payments Continuously Increased in Germany, Austria, and Switzerland in 2021

- First-Time High Values Across All Industries - Some Rates Exceeding 90%

- Paying at the Checkout Becomes Easier and Faster

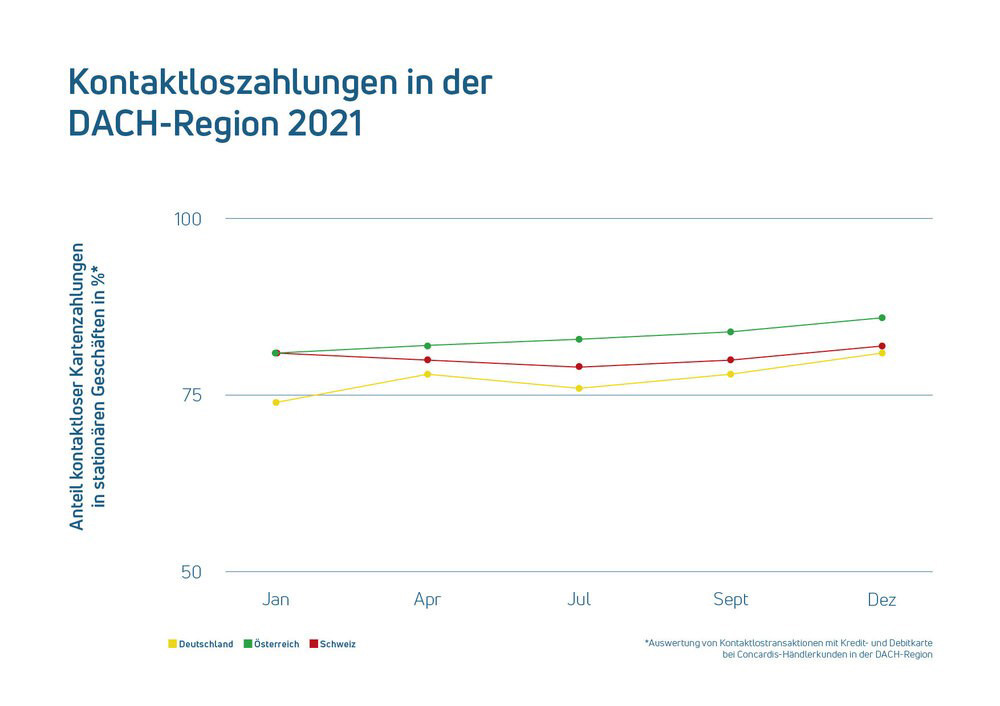

Eschborn, 9. March 2022. The share of contactless payment transactions at checkout counters in Germany, Austria, and Switzerland reached a new record high in 2021. Across all countries in the DACH region, significantly more than 80 percent of people opt for contactless payments when paying electronically. This is according to the latest analysis by Nexi, a leading PayTech company in Europe.

In January 2021, the share of contactless transactions in Germany stood at 74%, already 24% points higher than the previous year. By December 2021, this figure had risen to 81%. Among the German-speaking countries, Austria had the highest proportion of contactless payments in December, reaching 86% compared to 81% at the beginning of the year. Switzerland also reached its highest annual figure in December, with a share of 82%.

NFC technology firmly established at the checkout

Since the beginning of the COVID-19 pandemic, contactless payments have received a significant boost. "Nowadays, four out of five people pay contactlessly with cards or smartphones at Nexi terminals," says Robert Hoffmann, CEO of Nexi and Nets Merchant Services. "The fact that the contactless payment rate in the DACH region has increased again in 2021 shows that NFC technology has firmly established itself. This is the prerequisite for smart, new payment methods that will further simplify and accelerate the checkout process at the registers." Today, more and more consumers are paying effortlessly with smartphones and wearables like smartwatches.

In Germany, while some sectors like drugstores, bakeries, or grocery stores had already reached very high levels of contactless payments, peaking at up to 95% at the beginning of the year, the rates have also increased significantly in other segments. For example, in shoe stores, the proportion was below 49% at the start of 2021 but steadily increased throughout the year, reaching 78% in December. A similar trend is observed in fashion stores, hotels, or gas stations..

The benefits outweigh security concerns

Hoffmann emphasizes that the advantages of contactless payments have convinced consumers in their daily lives. "Where there was initially skepticism about paying with tap and go, the benefits have proven themselves in practice for many people: contactless payment is faster, easier, and more hygienic." At the same time, consumers' concerns about security have not been confirmed. "NFC is a very secure way to authorize payments," says Hoffmann. The widespread use paves the way to rely entirely on NFC-based solutions in the future, such as SoftPOS. This allows cashless payments to be accepted via mobile devices such as tablets, smartphones, or Personal Digital Assistants (PDAs) instead of a traditional card reader..

According to the analysis of payments made with the Girocard in 2021, the EURO Kartensysteme also reported similarly high usage numbers. According to information from the joint venture of the German banking industry, 73% of Girocard payments were processed contactlessly by the end of the year. Overall, the Girocard, still commonly referred to as the EC card, has never been used as frequently as it was in the past year. According to the EURO Kartensysteme, contactless payment has been the "driving force behind this development''.