- Contactless payments at record high according to Nexi analysis: 95 percent usage in bakeries / Average across all sectors stands at 85 percent

- Simultaneously, the usage of e-wallets for point-of-sale (POS) payments is increasing: 45 percent of young adults utilize smartphones and similar devices for in-store payments

- "This will change the entire checkout experience at the point of sale," says Carola Wahl, CEO Nexi DACH & Group ExCo Member of Nexi Group

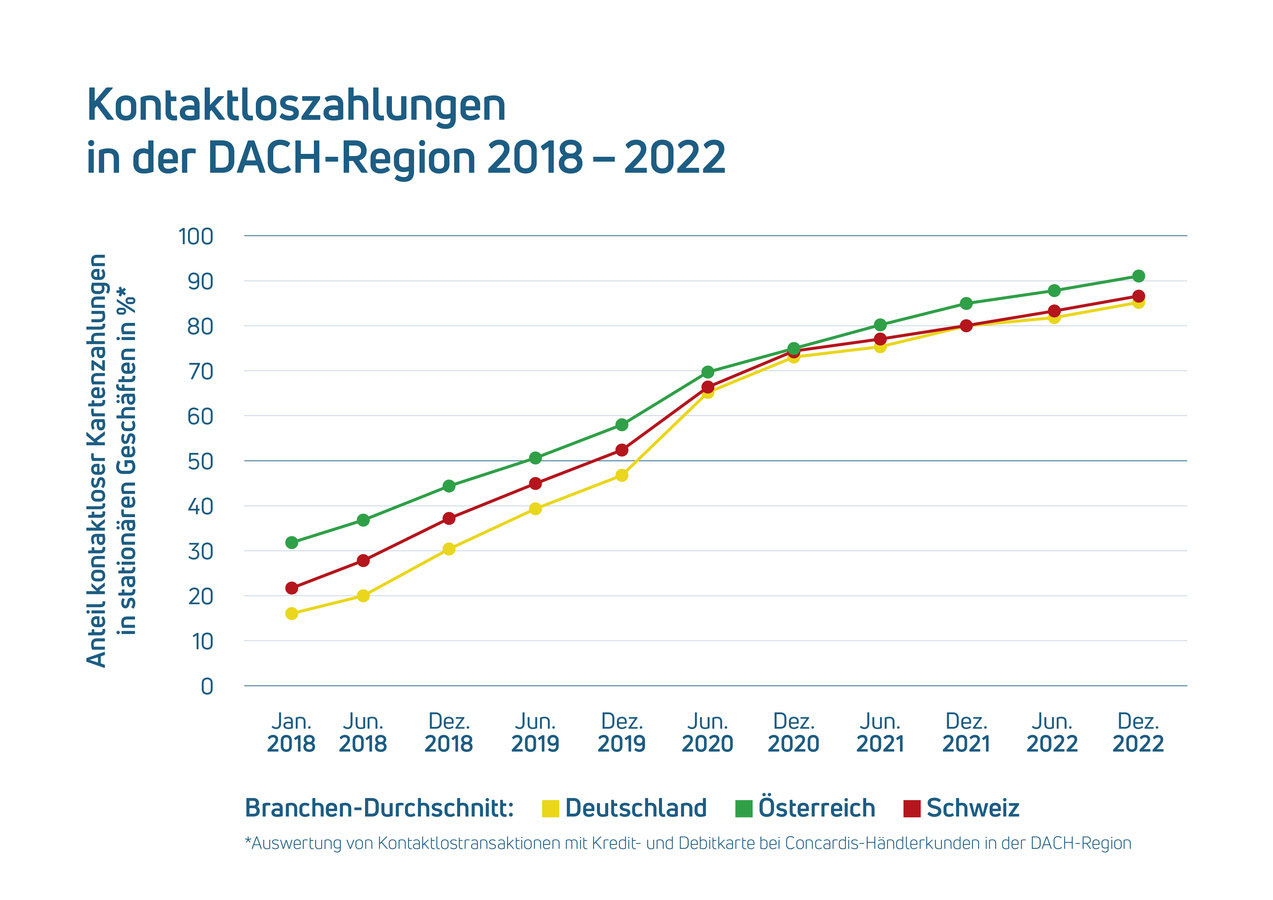

Eschborn, February 13, 2023. In German bakeries, 95 percent of cashless transactions are processed contactlessly today, while it's 91 percent at kiosks and 90 percent in supermarkets. This is revealed by the latest analysis of merchant transactions for the year 2022 by payment provider Concardis, part of the Nexi Group, one of Europe's largest PayTech companies. Across all industries, the average contactless payment rate in December 2022 is 85 percent, marking an all-time high. Three years prior, before the COVID-19 pandemic, the share was less than half of all cashless payments.

"We're witnessing a sustainable shift in consumer payment behavior at the point of sale," says Carola Wahl, CEO Nexi DACH & Group ExCo Member of Nexi Group responsible for the entire DACH business of Nexi Group. "This will transform the entire checkout process in brick-and-mortar retail, as contactless payments increasingly involve the use of smartphones. This allows for the integration of all digital processes with payment, such as collecting loyalty points or receiving digital receipts." This accelerates payment processes overall because there's less interaction required at the checkout. According to the Bundesbank, the pure payment process with a card takes around 30 seconds, while with contactless payment without PIN or signature, it averages only 14 seconds.

45 percent of young people pay with a smartphone or watch

''In sectors and stores frequented regularly, such as bakeries, newsstands, or supermarkets, the use of Tap and Go has largely supplanted traditional card insertion," Wahl notes. "This trend is further facilitated by the fact that many transactions in these areas fall below the 50-euro limit, eliminating the need for signatures or PINs during contactless payments. As a result, contactless payment offers heightened speed and convenience for both consumers and entrepreneurs alike.

But also in other sectors such as fashion stores (80 percent), bookstores (84 percent), hair salons (85 percent), drugstores and pharmacies (85 percent), or restaurants and bars (85 percent), the share of contactless payments is at an all-time high. While the use of contactless payment methods had been steadily increasing in the years prior to the pandemic, the COVID-19 crisis dramatically altered payment behavior in a short period of time. In December 2019, the contactless payment rate in Germany was around 47 percent, which surged to 70 percent in April 2020. Since then, the share has continued to rise, even after the lifting of government restrictions.

The increasing prevalence of contactless payment transactions being conducted directly via e-wallets such as Google Pay or Apple Pay, rather than through physical card presentation, is highlighted by a representative survey conducted by GfK on behalf of Mastercard in November 2022. One in four individuals had used their smartphone or smartwatch for payment at least once in the past twelve months. Notably, the trend of smart payment via mobile devices or wearables is particularly popular among young adults. In the 18-29 age group, 45 percent used an e-wallet at the point of sale (POS), marking a 12 percentage point increase compared to the previous year.