.png)

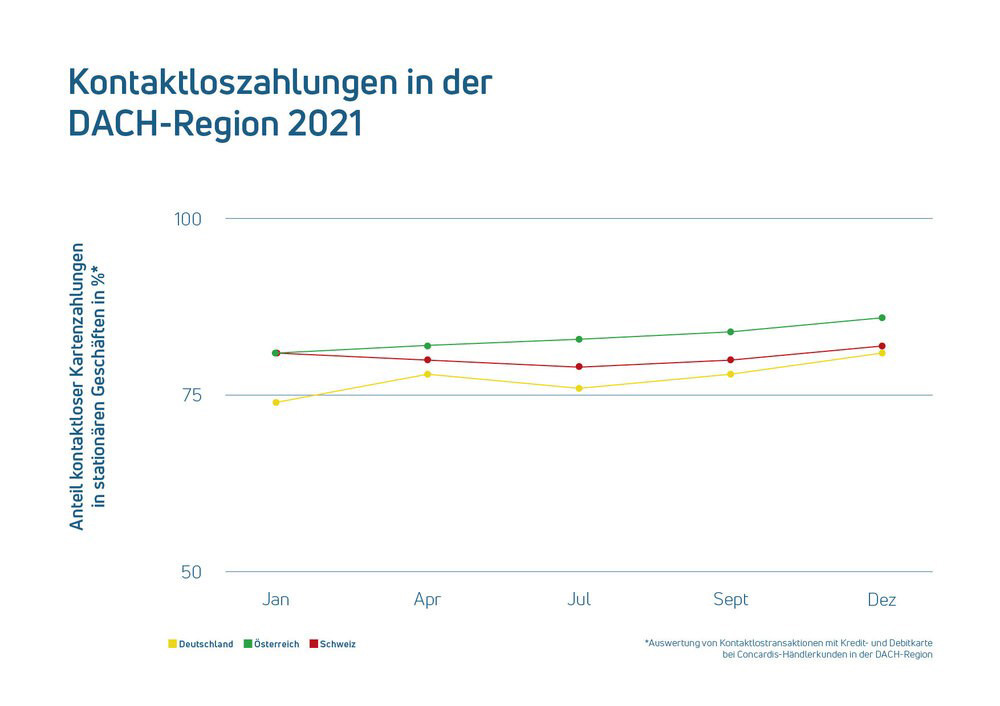

- Across industries, contactless payments reached an average of up to 86 percent in the DACH region by the end of 2021

- The share of contactless payments in Germany, Austria, and Switzerland continuously increased in 2021

- For the first time, high values were recorded in all industries – in some cases, rates exceeded 90 percent

- Paying at the checkout becomes easier and faster

Eschborn, March 9, 2022. The share of contactless payment transactions at checkout counters in Germany, Austria, and Switzerland reached a new record high in 2021. In all countries of the DACH region, significantly more than 80 percent of people pay contactlessly when making cashless payments. This is according to the latest analysis by Nexi Group, one of Europe's leading PayTech companies.

In January 2021, the share of contactless transactions in Germany stood at 74 percent—already 24 percentage points higher than the previous year. By December 2021, it had increased to 81 percent. Austria recorded the highest proportion of contactless payments among German-speaking countries in December, reaching 86 percent compared to 81 percent at the beginning of the year. Switzerland also reached its highest annual figure in December, with an 82 percent share.

NFC technology at the checkout has become firmly established

Since the beginning of the COVID-19 pandemic, contactless payments have received a significant boost. "By now, four out of five people pay contactlessly with cards or smartphones at our terminals," says Robert Hoffmann, former CEO of Concardis and Nets Merchant Services. "The fact that the contactless payment rate in the DACH region has risen again in 2021 demonstrates that NFC technology has firmly established itself. This is the prerequisite for smart new payment methods that will further simplify and speed up the checkout process at the cash registers." Increasingly, consumers today are paying quite naturally with smartphones and wearables such as smartwatches.

In Germany, while some sectors like drugstores, bakeries, or grocery stores already had a very high proportion of contactless payments at the beginning of the year, settling at up to 95 percent, the rates have also increased significantly in other segments. For example, in shoe stores, the share was still below 49 percent at the beginning of 2021 but steadily increased throughout the year, reaching 78 percent in December. Similar trends are observed in fashion stores, hotels, or gas stations

The benefits outweigh security concerns

Hoffmann emphasizes that the benefits of contactless payments have convinced consumers in their daily lives. "Where there was initially skepticism about tap and go payments, the advantages have proven themselves in practice for many people: contactless payments are faster, easier, and more hygienic." At the same time, concerns of consumers regarding security have not been confirmed. "NFC is a very secure way to authorize payments," says Hoffmann. The widespread use paves the way to eventually rely entirely on NFC-based solutions such as SoftPOS. This allows for cashless payments to be accepted via mobile devices such as tablets, smartphones, or Personal Digital Assistants (PDAs) instead of using a traditional card reader.

The EURO Kartensysteme also reported similarly high usage figures for payments with the Girocard in 2021. According to the joint venture of the German banking industry, 73 percent of Girocard payments were processed contactlessly by the end of the year. Overall, the Girocard, still commonly referred to as the EC card, has never been used as frequently as it was in the past year. According to Euro Kartensysteme, the "driver of this development" is contactless payments.